LOST IN COTTON FIELD!

The Pico Ag Solution to a worldwide cotton industry crisis:

Low Prices means no body will grow cotton! Our technology can produce over twice the USA Average at close to 1600lbs acre.

Pico Ag is Looking forward to solving the viability of a cotton industry in the USA, and the world. I have some friends at PF that will help us get the word out.

Once we meet with the Major Cotton Farmers and Distribution we can progress.

As we have demonstrated on over 500 acres in 2015 that production increase is simple. Doubling the pounds per acre, Doubles the money for the farmer of cotton per acre, And Doubling the money for the Cotton Industry. People have got to think dollars per acre and not

price per pound. Today cotton is .638 cents per pound, with new production, the adjusted price per acre will be effectively between $1.24 to $1.50 a pound. Price is important, but pounds per acre is more important.

At 3 applications our product total retail cost is just $18.00. The Return on Investment (ROI) using our product is 30 to 1. 10,845,000 acres x 3 applications = 32,535,000 sprayed acreage x $6.00 an acre that would be

$195 Million Dollars.

This is our 2015 experience east of I-95 in North Carolina. A Farmer increased production of cotton per acre by 900lbs for just $18.00

Last night we got a call from a very excited Eastern North Carolina Cotton farmer that had used 3 applications of Soysoap for a total of $18.00.

He also had several of his fellow farmers use the Soysoap and got the same results.

He told me he is expecting an increase in Cotton of over 900 lbs more than he had ever grown before, based on the number of cotton boles. The top of the plant was almost 6 feet tall so

he had lots of branches to hang lots of boles. The top branches had 20 boles all the way to the bottom branch that had 10 boles for about 100 boles per plant.

The Farmer had grown cotton for 50 years and would make about 40 boles per plant, and grew about 602 lbs cotton per acre average over 3 years 2012-2014.

I have always said right or wrong that Cotton prices are certainly a concern, but if I can make twice or more the cotton per acre than it is like doubling the price of cotton. If Cotton was .63 cents, for example a pound, an

we could help the farmer grow 250% more pounds per acre. Biobased can give the farmer 100 boles or 900 more lbs and that would be $540 of extra cotton for just $18 of 3 applications that is a 30 to 1 ROI.

Any farmer would be happy with those results of increasing from 600 to 1500 lbs per acre or 2.5 times the national average per acre.

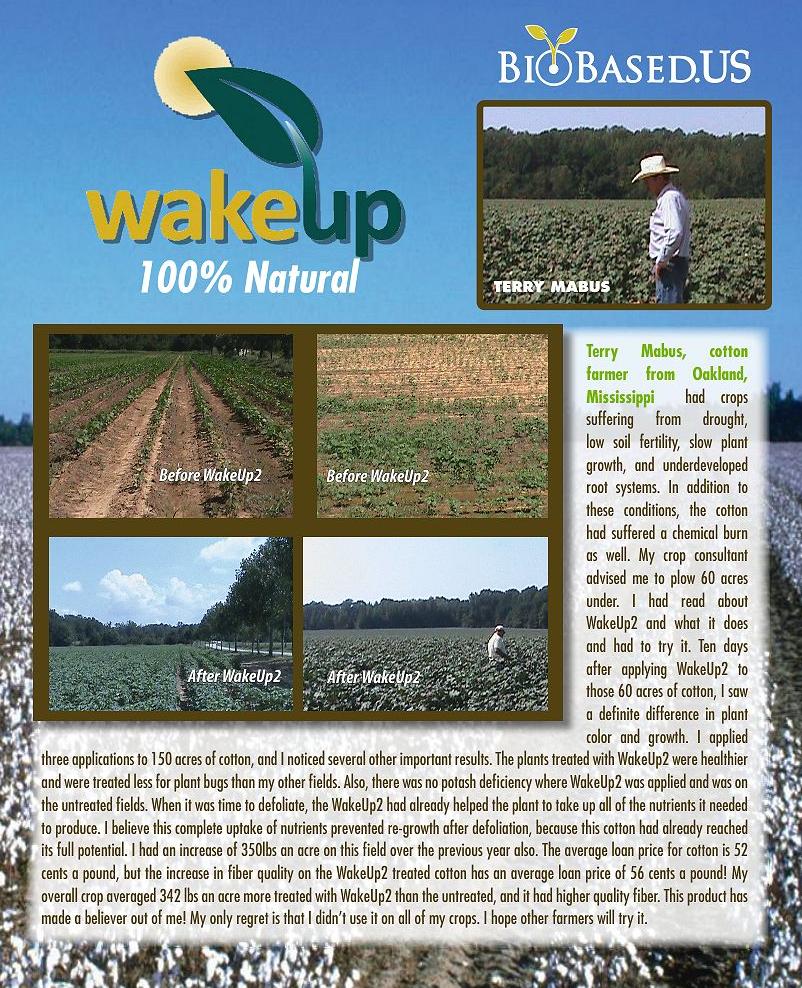

Terry Mabus Oakland, Mississippi, Cotton Results Averaged 342 More Lbs Per Acre vs the control

Terry Mabus Oakland, Mississippi, Cotton Results Averaged 342 More Lbs Per Acre vs the control

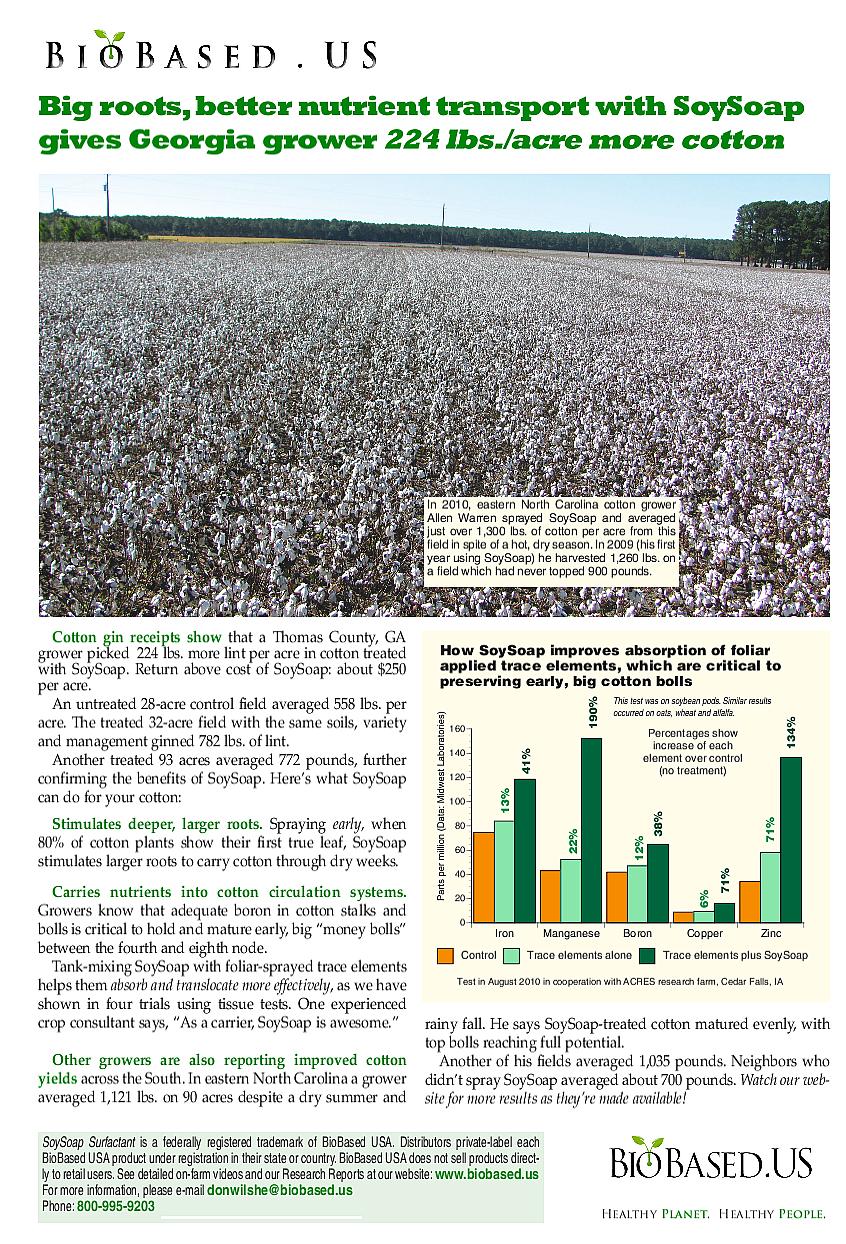

Interviews Allan Warren about! Soysoap got us another 300 pounds cotton per acre.

Interviews Allan Warren about! Soysoap got us another 300 pounds cotton per acre.

Cotton Farmer Chipley, Florida reported when Soysoap used 20 Bolls in just the first 3 leaves, and lots of other benefits, Lots of Ruffing Bolls,

Lots of Fruit in the bottom of the plants, Once they start growing it is amazing.

Cotton Farmer Chipley, Florida reported when Soysoap used 20 Bolls in just the first 3 leaves, and lots of other benefits, Lots of Ruffing Bolls,

Lots of Fruit in the bottom of the plants, Once they start growing it is amazing.

Georgia Cotton Farmers Gets 224 More Cotton Per Acre

Mississippi Takes a heavily damaged Cotton Crop From Catoron, Reverses the crop damage and Gets 342 more pounds Cotton per acre.

|

| | |